A Journey through M&A

A journey through M&A: An Interview with an Oaklins associate - Naomi Muller

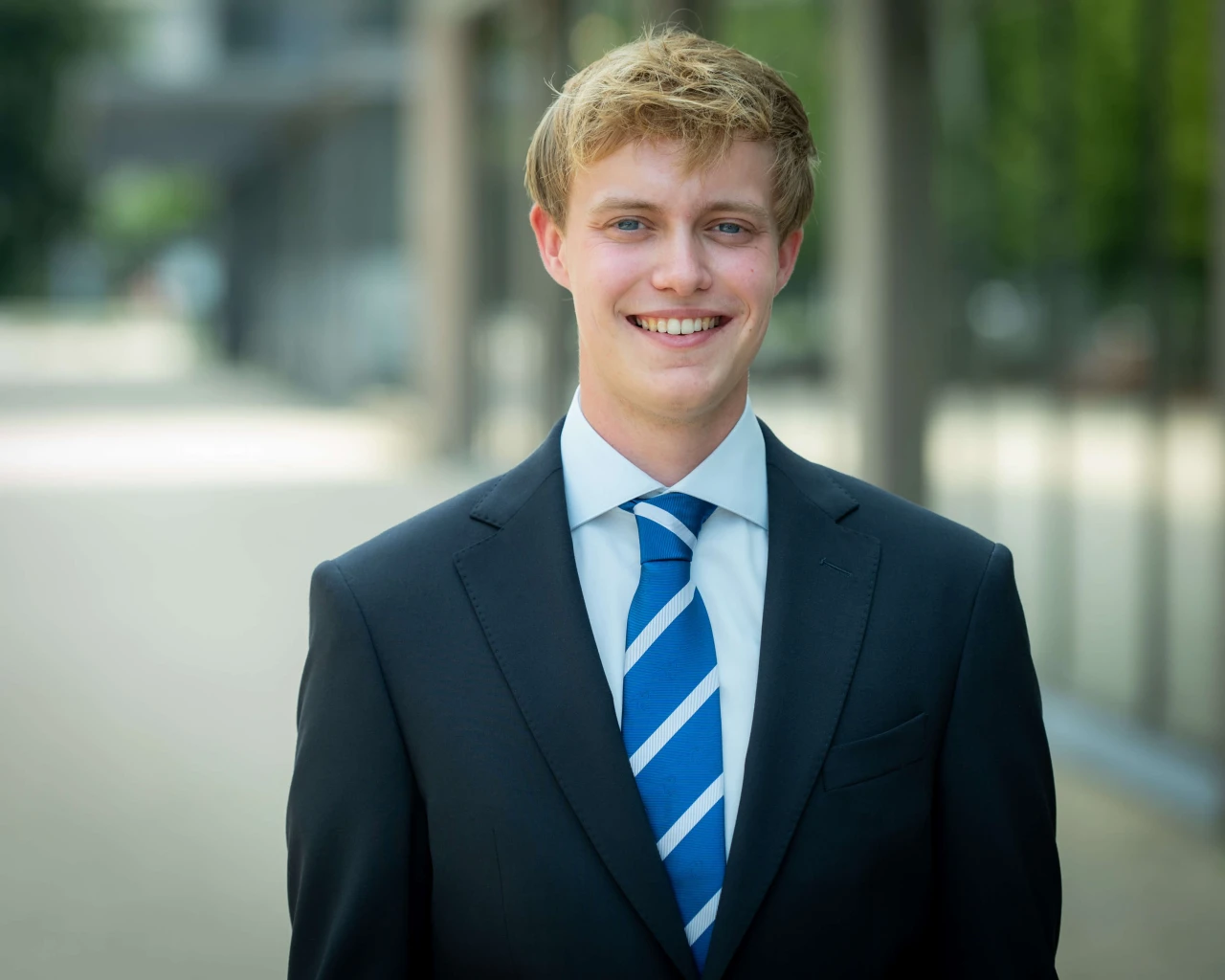

NAOMI MULLER

Study: Financial Economics at Erasmus University

Occupation: Associate at Oaklins

Can you introduce yourself and tell us how you ended up at Oaklins?

I am currently an Associate at Oaklins, but my journey with the company has been very dynamic over the past three years. I initially joined as an intern during my studies and later continued as a working student. Despite exploring opportunities elsewhere, including internships at ABN AMRO in the midcap Natural Resources M&A team and Bank of America, I found myself drawn back to Oaklins. The entrepreneurial spirit, independence, great colleagues, and international network convinced me to return to Oaklins. I began as an analyst and have now progressed to an Associate role in the Mid Cap team.

Could you provide an overview of Oaklins and its focus in the corporate finance landscape?

Oaklins is a corporate finance boutique specialising not only in M&A, but also in equity capital markets (ECM) and debt advisory. We have dedicated teams for ECM and debt advisory, and within the M&A team, we further differentiate between Small Cap and Mid Cap deals (ranging from 25 to 250 million enterprise value). Our Mid Cap team comprises 20 members, contributing to the overall 55-strong workforce at Oaklins in the Netherlands. Recently, we expanded our services with a valuation section to cater to a broader market, reflecting our continuous growth.

What attracted you to M&A, and how did you decide to start your journey with a stage at Oaklins?

Various aspects of my life and educational background leaned towards M&A. My side job at a family office during high school sparked my interest in entrepreneurship and influenced my decision to join the study association B&R Beurs, which further developed my interest in finance. I pursued a bachelor in Economics and Business Economics and a master in Financial Economics at Erasmus University, where I got a better insight into finance. The decision to apply for an M&A internship at Oaklins was driven by the company's entrepreneurial spirit, ambitious colleagues, independence and the opportunity to engage in the entire deal process.

How has your educational background prepared you for the role of an M&A Associate?

My master's in Financial Economics, along with relevant courses during an exchange programme in Barcelona, provided a conceptual understanding of Corporate Finance. While practical experience often differs from textbook scenarios, the seminars, taught by industry professionals were invaluable in preparing me for the role.

Does Oaklins offer specific training programs or courses to further develop skills?

Oaklins has an extensive training programme for their employees (the Oaklins Academy) and even for their interns (the Intern Academy). We engage in (inter)national courses, covering topics like valuation, negotiation, presenting and other aspects of the M&A process. Courses are delivered by both internal experts and external resources, all aimed at enriching our continuous education in the field of finance.

Could you walk us through a typical day as an M&A Associate?

Not a single day is the same in M&A, but typically, I start by checking emails. Currently, we are working on an information memorandum for a deal, a comprehensive overview of a company. Much of my day is spent working on this memorandum, collaborating with the analyst on the deal. There are also introductory meetings with potential buyers or sellers, internal financial model discussions, and occasional Tuesday afternoon courses. To balance work with health, many people often engage in sports around 5 o'clock. We frequently have a large group going for a run or attending a fitness class somewhere, personally, I prefer going to the gym

On average, how many deals do you work on simultaneously?

Associates usually handle 2 to 3 mandates simultaneously. Our deal teams often consist of four individuals: a partner, an (associate)director, a (senior) associate, and an analyst. The analyst is often supported by an intern, whom we are pleased to involve in the current processes we are undertaking. The entire process typically spans 7 to 8 months.

Are there current trends in M&A that have caught your attention?

The general M&A market has seen a downturn last year due to rising interest rates, inflation, geopolitical tensions and signals of a looming recession. This has made both buyers and sellers more cautious about engaging in deals as the valuation gap grew In addition, attracting external financing has been more difficult over the past year, further impacting the dealmaking environment. However, in the midmarket segment, in which Oaklins operates, the impact has been notably manageable. Our office in the Netherlands closes approximately 50 to 60 deals per year. In addition, another trend we see is a growing number of deals with alternative structures with post-deal payments. This trend is largely driven by enhanced private equity involvement in transactions. Deal structures often include earn-outs and vendor loans, decreasing the cash amount paid at closing.

What are the key conditions for successfully closing a deal according to Oaklins?

Successfully closing a deal requires a deep understanding of market dynamics and specific value drivers, ample industry experience, and a unique international reach with contacts at key potential strategic buyers. Oaklins excels in successfully closing deals by leveraging deep market understanding, vast industry experience, and an extensive international network. Our top-tier process management ensures tailored sales strategies for maximum value, speed, and favorable terms. With a dedicated and expert deal team, we streamline processes to optimize shareholder outcomes while satisfying the buyer/seller and/or management and a successful future trajectory of the business

What are the biggest challenges you face in your role?

Balancing the need for speed, quality, and satisfaction from all parties involved is sometimes tricky. Transparency and effective communication are very important, ensuring everyone is aware of what to expect, while fostering a collaborative environment.

What qualities make someone a successful M&A Associate?

Being entrepreneurial, driven, and intrinsically motivated to constantly learn and explore beyond the surface are key attributes. Strong communication skills are essential due to the frequent interactions with the team and clients. While a finance background is common, diversity in educational backgrounds is embraced at Oaklins.

Does Oaklins focus on specific sectors, and are there any special areas of focus?

Initially, new hires are trained to be sector-agnostic, exposing them to a wide range of industries. However, as individuals progress, they develop specific sector expertise. Our team includes sector specialists, for example we have our Managing Partner that specialises in TMT (Technology, Media and Telecommunications). Other examples of specialisations can be found in the fields of Horticulture, Business Services, Healthcare, and Consumer & Retail.

What are your ambitions for the coming years?

My immediate goal is to continue growing within the M&A field. I really enjoy the work and there are still several steps to take within my career. Specialising in TMT is something I am considering, but all options remain open and I am curious for what the future hold.

Are there opportunities for individuals interested in joining Oaklins?

We are always on the lookout for talented individuals, and our doors are open to interns year-round. Many of our interns transition to analyst roles, and we typically have around sixteen interns annually. While a financial background is beneficial, individuals with strong quantitative skills and a genuine interest in finance are encouraged to reach out.

How would you describe the atmosphere and work culture at Oaklins?

Oaklins maintains a flat organisational structure, fostering a culture of openness and collaboration. Initiatives like the Wine Club, regular team activities, and a balanced mix of work and social events contribute to a vibrant work environment. Whether it's discussing deals over a run, or organising Friday afternoon gatherings, there's always something going on.

Check out the opportunities at Oaklins:

Are you looking to gain some experience within the field of M&A at Oaklins? See several opportunities at Oaklins below: